Author:

Source: https://www.nalaiyaseithi.com

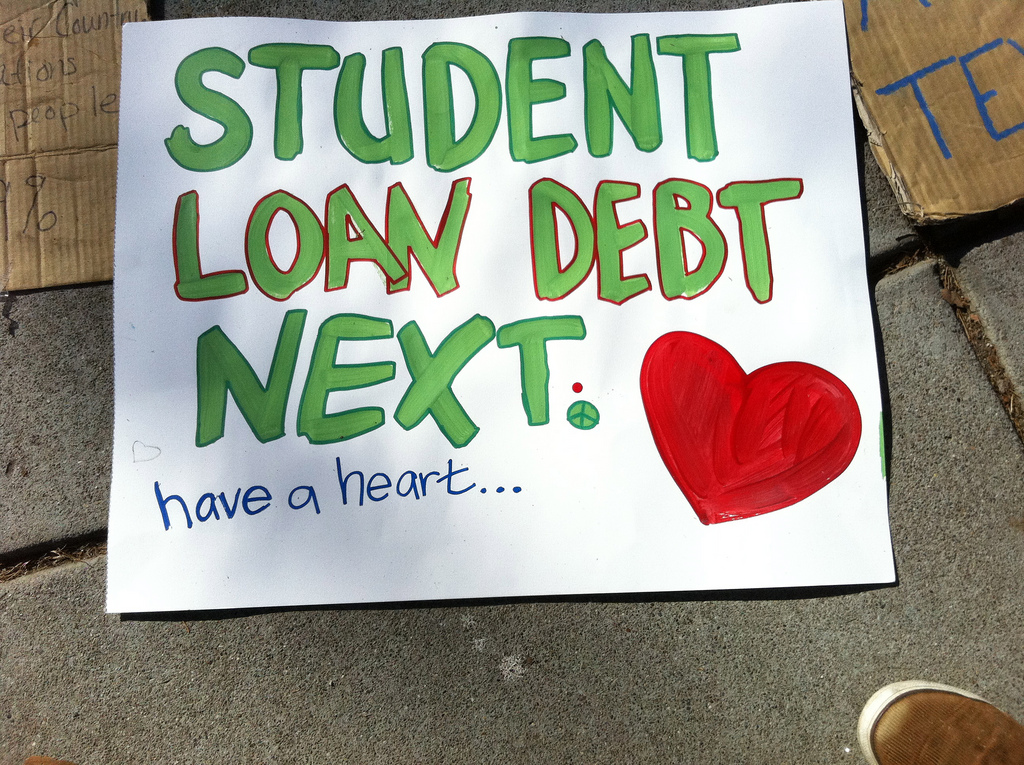

There are some big changes on the horizon that could impact your student loans.

Here are 7 student loan changes to watch for and what you need to know:

1. Student Loan Forgiveness

There is no guarantee that student loan forgiveness will continue in its current form, or at all.

While student loan forgiveness may benefit borrowers, the federal

government essentially pays for student loan forgiveness. That means

taxpayers may be at risk for forgiving student loans

Current participants in Public Service Loan Forgiveness (10 years to

student loan forgiveness) or income-based repayment programs (20 to 25

years for student loan forgiveness) may be expected to be safe for

student loan forgiveness, but the future of student loan forgiveness may

change.

What It Means For You: While student loan forgiveness may end, student loan forgiveness may not be worth it to student loan borrowers in the long run. You may be able to pay off student loans faster or refinance student loans to save money.

MORE FROM FORBES

2. Student Loan Repayment

In 2016, President Trump proposed to combine the existing

income-driven repayment plans - such as Pay As You Earn (PAYE) and

Revised Pay As You Earn (REPAYE) - into a single plan to make it less

confusing for borrowers.

Make sure you understand the difference between student loan consolidation and student loan refinance.

What It Means For You: Remember, federal

student loan repayment plans are only for your federal student loans. If

you have private student loans - and most people do - you need an

action plan to pay off your private student loans too.

3. Variable Rate Student Loan vs. Fixed Rate Student Loan

Student loan rates are increasing.

When you borrow or refinance your student loans, you have a choice

between a fixed interest rate and a variable interest rate. There are

advantages and disadvantages to each choice.

This year, the Federal Reserve says it will raise interest rates four

times this year. Each time interest rates increase, you may pay more

for your student loans if you have a variable interest rate student

loan.

While this is good news for savers in the form of higher yielding

savings accounts, higher interest rates adversely affect consumer

borrowers with variable interest rate loans such as student loans (as

well as credit card and mortgage debt) in the form of higher interest

costs.

If you borrow a new student loan, you should consider a fixed interest rate student loan.

What It Means For You: If you currently have a variable interest rate student loan, you can refinance student loans and convert variable interest rate student loans to a fixed interest rate student loan.

4. Increased Role of Private Sector & Banks

President Trump wants to increase the role of the private sector -

particularly private lenders such as banks - in the issuance of federal

student loans. Why? Trump believes that the federal government generates

too much "profit" from issuing student loans, and wants private sector

lenders to participate in federal student loan origination.

What It Means For You: How can student loan

borrowers benefit from banks and other financial services companies

increasing their participation in student loan origination? There may be

several benefits, but prospective student loan borrowers would, at a

minimum, be looking for lower student loan interest rates, better

customer service and a more simple student loan application process.

5. Colleges & Universities: Financial Responsibility For Student Loans?

The high cost of tuition at many colleges and universities has led

students to borrow more to fund the cost of their education. Financial

aid, scholarships and other financial support help offset the cost of

higher education. However, Trump called on colleges and universities

with large endowments to help lower the cost of tuition, or face

potential loss of tax exempt status.

What It Means For You: Will there be

increased risk sharing and financial responsibility between the federal

government and colleges and universities? Currently, there is a mismatch

in risk sharing and financial responsibility: colleges and universities

set tuition rates, but the federal government assumes all default risk

on federal student loans. If the proposal is implemented, tuition rates

could decrease and therefore students would borrow less debt.

6. Proposed Legislation

Over the past year, there have been multiple legislative bills

proposed in Congress to help alleviate the student loan debt burden.

According to the latest student loan statistics from Make Lemonade, more

than 44 million Americans owe $1.5 trillion in student loan debt.

Student loan borrowers are even asking whether their student loan debt

can impact their ability to buy a home.

Here is a rundown of some of these bills:

- Reauthorization of the Higher Education Act: the primary law that governs higher education, including student loans, which is reauthorized every five years

- Private Student Loan Bankruptcy Fairness Act: would allow private student loans to be discharged in bankruptcy

- Parent PLUS Improvement Act: makes changes to Parent PLUS Loans.

- Various Employer-Sponsored Student Loan Repayment Plans: proposals to create incentives for employers to help their employees repay their student loan debt

- Strengthening Communities Act: would provide free tuition at community colleges for two years and other tuition reductions

- REDI Act: would provide interest-free deferment on federal student loans for doctors with medical school debt while in a residency program.

What It Means For You: There are multiple legislative bills in various stages in Congress. Stay tuned.

7. New Student Loan Rates

The interest rates for federal student loans are determined by

federal law. Interest rates reset every July 1 and run for one year

until June 30. All federal student loans are fixed interest rates loans

(although you can refinance student loans to receive a fixed interest rate).

What It Means For You: While these new

student loan interest rates affect new borrowers, your variable rate

student loans may reset monthly so pay attention to your interest rate.